As seen in Zumper

Notable trends

- The national rent index saw one-bedrooms increase 1.5% this June to $1,526, while two-bedrooms grew 1.9% to $1,900.

- Housing will remain a challenge for the Federal Reserve’s efforts to lower interest rates this year as inflation stays sticky and national rent prices continue to increase.

- Minimal declines to Florida rent prices amidst one of the largest supply influxes to the state demonstrate how massive the demand is there.

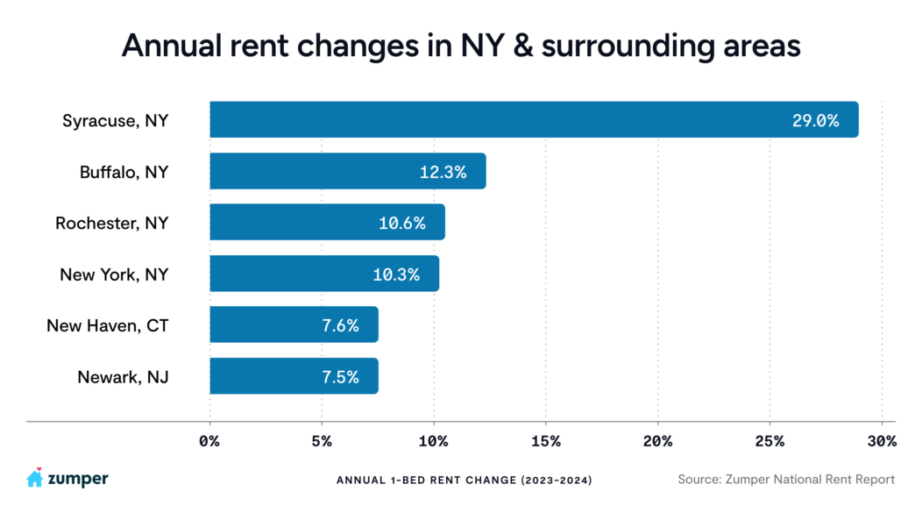

- All 4 cities in New York had annual rent rates up in the double digits with demand even spilling into surrounding markets.

Lowering interest rates will remain a challenge for the Fed as inflation stays sticky and Zumper’s national rent index continues to grow

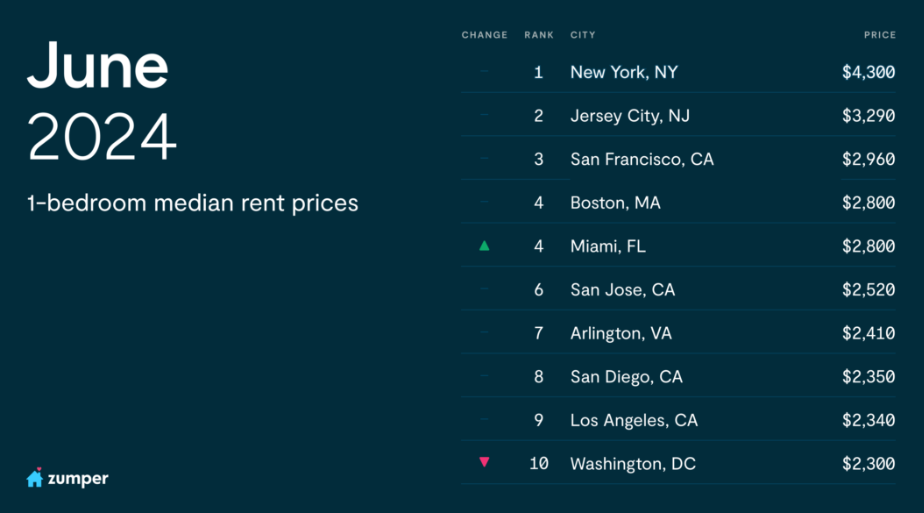

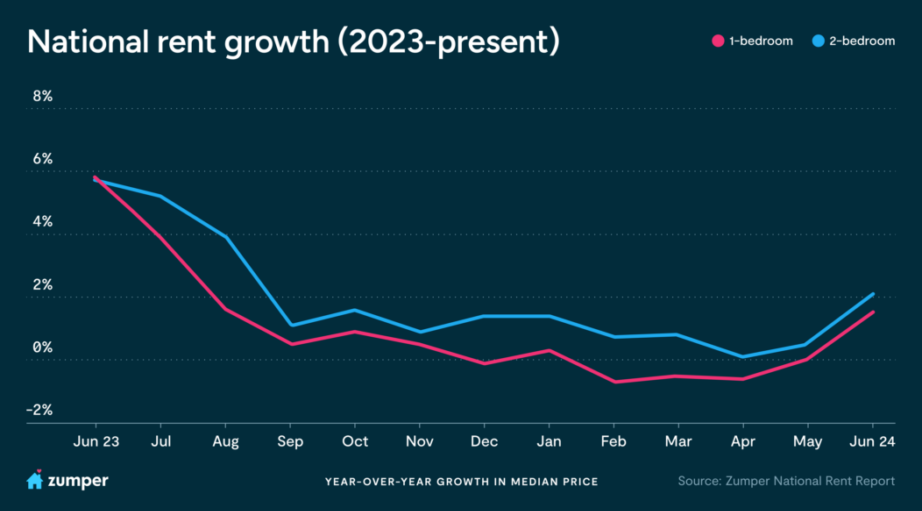

Produced monthly by the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) is a measure of the average change overtime in the prices paid by urban consumers for goods and services, including the cost of shelter in general, rent prices in particular. The most recent CPI data revealed that the index for shelter rose in May, up 0.4%, for the 4th consecutive month. Since there is a lagging nature to the CPI’s shelter cost component, as the government surveys a rolling sample of households every 6 months as part of its calculation, our National Rent Index serves as a leading indicator of shelter CPI because our data measures asking rents today. Our national rate for one-bedroom units rose 1.5% this June, settling at $1,526, while two-bedrooms increased 1.9% to $1,900. The national index continuing this trend of monthly growth coupled with the current persistent inflation suggests that housing will remain a challenge for the Federal Reserve’s efforts to lower interest rates this year.

“We may have finally returned to the first normal renting season since 2019,” says Zumper CEO Anthemos Georgiades. “Following a soft winter, last month our national index recorded the highest monthly gains since the Fall of 2022 and rent growth has begun to accelerate into summer.”

Annually speaking, our national one and two-bedroom rents are up 1.5% and 2.1%, respectively. As a reminder, although the national rates are currently fairly low, they have not offset the large rent spikes experienced in the last few years as the national one and two-bedroom prices are still $300-$400+ more expensive than 4 years ago.

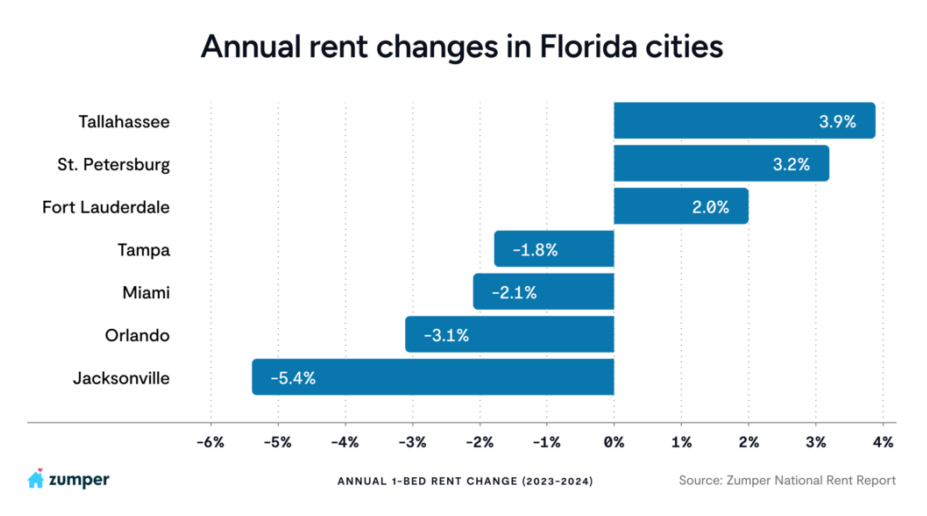

Florida rent rates reflect massive demand

After two years of leading the nation for price hikes, when rents in Miami, for example, were consistently up over 40% in the spring and summer months of 2022, Florida has seen a large influx of supply this year that has helped combat its demand. Of all U.S. subregions, the Sunshine State had the 3rd largest inventory growth overall with about 66k new rental units delivered at the end of the first quarter of 2024. Orlando led the pack with the largest amount of added supply, followed by Tampa, Jacksonville, and Miami. As reflected by the annual rent price changes in our data, those same 4 markets were the Florida cities with rates in the negatives. However, even though these cities are experiencing declining prices, the fact that they are not down more significantly, due to the huge addition of new inventory, demonstrates how truly massive the housing demand is in Florida. Other states with large amounts of new supply have experienced much bigger slowdowns. Raleigh in North Carolina, for instance, has rent down over 9% annually.

Meanwhile, Tallahassee, St. Petersburg, and Fort Lauderdale did not have as large of supply hits to absorb demand so rents in those cities are up a few percentage points from last year. Tallahassee is also the most affordable Florida city in our report so many renters who have become priced out of other markets, from the rent spikes experienced in the last 2 years, may be turning to Tallahassee for cheaper cost of living, which puts upward pressure on rents there.

All 4 cities in New York had annual rent rates up in the double digits

The New York rental market continues to dominate in terms of rent growth as all 4 cities in this state that are in our report had annual rates up in the double digits. Syracuse rent remained the fastest growing, rising 29%, while Buffalo, Rochester, and New York City followed suit with rents all climbing over 10%. The considerable demand present has even spilled into surrounding markets like Connecticut and New Jersey as New Haven and Newark both saw rents increase over 7% since this time last year.

New York City’s vacancy rate has reached a historic low of 1.4%, taking a nosedive from the 4.5% rate it was at only 2 years ago. While New York City’s net housing stock has grown by about 2% in the last 5 years, which is a significant addition for the market, this rate is still considerably smaller than the national average of 10%. Additionally, the New York metro area has not only recovered all jobs lost during the pandemic, it currently has an employment base that is actually 2.5% above the level seen in February 2020. The demand in this area is apparent while the supply has not grown nearly enough, creating an incredibly tight rental market that’s fueling high prices.

Meanwhile, Rochester, Buffalo, and Syracuse all continue to have occupancy rates above the national average as well. As we head into the summer and fall months, prices and demand will likely only continue to grow in this state as competition tends to be fiercest during that time of year.