As seen on JPMorgan.com

Inflation is at 40-year highs, but interest rates aren’t. Find out how rate increases could impact real estate investors.

Inflation—and rising interest rates—are at the center of the American economic conversation. And for good reason.

In June 2022, the Fed increased interest rates by 75 basis points—its largest move since 1994. The target federal funds range is now 1.5% to 1.75%, and the Fed anticipates more increases.

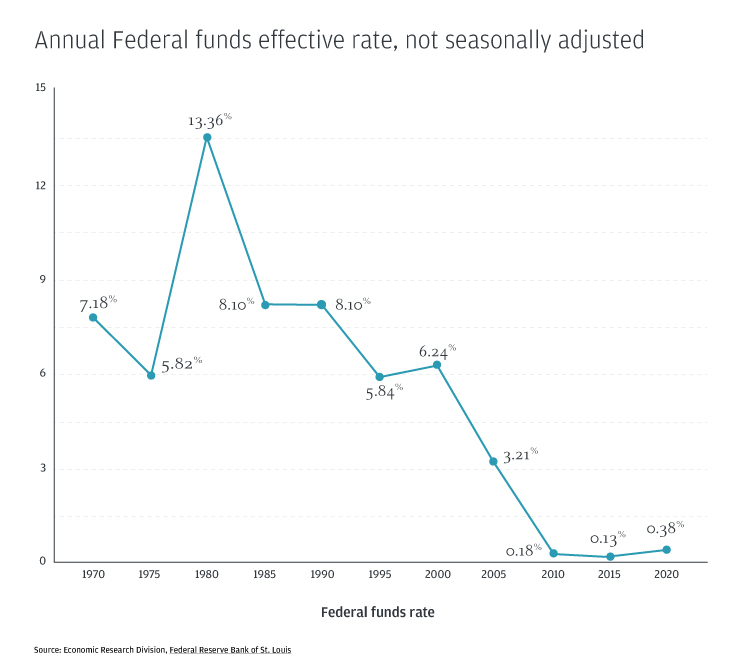

Keeping interest rates in historical perspective

Inflation is the highest it’s been since the early 1980s. Combined with the volatile swings in data throughout the pandemic, “We’re in uncharted territory,” said Ginger Chambless, Head of Research for Commercial Banking at JPMorgan Chase.

“By raising rates through this year, the Fed is trying to get a handle on inflation and slowly pull some of the excess liquidity out of the economy,” she said. “I think it makes sense for the Fed to take a gradual approach. This way, they can see how the economy holds up along the way, as opposed to a more drastic increase, which might cause undue panic in the markets.”

While inflation is at 40-year highs, interest rates are nowhere near 2000’s 6.5%, much less the record high of nearly 20% in 1980. Rates have returned to pre-pandemic levels.

“In terms of absolute levels, and in view of history, current interest rates are still at attractive levels,” said Mike Kraft, Head of CRE Treasury at JPMorgan Chase. “Generally, I would say this is a great time to do business—before additional rate movements kick in.”

What interest-rate hikes mean for multifamily investors

Taking out a loan to purchase a multifamily property or refinancing your apartment complex at a fixed rate may still be a smart move. However, you may want to look at more than interest rates. Consider other factors, including:

- Supply, demand and demographic shifts: The housing inventory—especially affordable housing—is low, with demand outpacing supply. As the economy opens back up and more people go out, there may be a move from the suburbs to cities for investors to consider. Likewise, more people have moved to the center of the country and are seeking workforce housing.

- Local market: Real estate is a largely local business, so you may want to take a close look at the specifics of your market before purchasing or refinancing. It’s also important to evaluate each property’s capitalization rate, which generally goes up when interest rates increase.

- Current financing structure: Interest rate hikes may have a greater impact on short-term loans than long-term ones, as may variable-rate financing. You may also want to keep an eye on the 10-year Treasury yield, which helps determine mortgage rates. The yield is also viewed as a sign of investor sentiment about the economy. Rising yields may reflect higher levels of expected inflation in the long term, whereas falling yields may indicate lower inflation along with the possibility of a slowdown or recession.

What’s next for interest rates, inflation and the economy

Kraft was quick to point out that while most signs of the American economy remain strong, there are always uncertainties. The war in Ukraine and the potential for new coronavirus variants are just a few of the outside factors to watch as the course of interest rates unfold.

Jamie Dimon, Chairman and Chief Executive Officer of JPMorgan Chase & Co., discussed the economic challenges in his recent letter to shareholders. “This is in no way traditional Fed tightening—and there are no models that can even remotely give us the answers,” he wrote. “In our current situation, the Fed needs to deal with things it has never dealt with before (and are impossible to model), including supply chain issues, sanctions, war and a reversal of quantitative easing in the face of unparalleled inflation.”