As seen in CoStar

Middle- and Lower-Income Renter Households Absorb Highest Rent Increases in Past Four Years

For the multifamily rental households that were struggling to pay rent before the pandemic, the health crisis that sent apartment rents skyrocketing from surging demand and lower vacancy made a difficult situation worse.

From the end of 2019 to the first quarter of 2024, the overall national asking rent for apartments increased 18%, to $1,691 per month from $1,435.

According to a recent analysis by Harvard University’s Joint Center for Housing Studies, half of all renter households spend more than 30% of their income on housing. What’s more, the analysis found that 25% of renters spend over half of their income on housing. Thus, the rising rent burden falls disproportionately on lower-income households renting units in properties rated three stars and one and two stars.

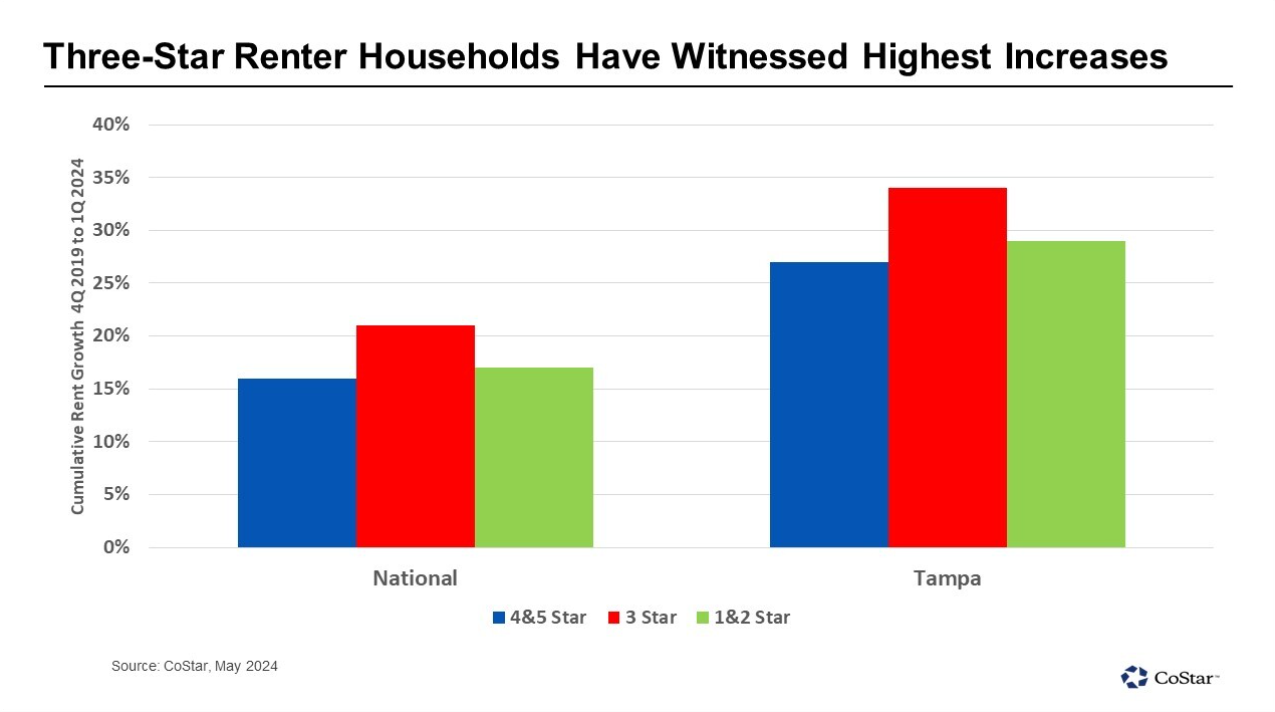

Breaking out rent increases by the different price points reveals that residents of apartments rated three stars have had to absorb the highest rent growth increases nationally with an average rent increase of 21% over the past 17 quarters. Following that, renter households in the generally more affordable properties rated one and two stars had the second-highest average rent increase at 17%. For lower-income families, small rent increases can have a significant effect on monthly household expenses.

Furthermore, rent growth over the past four years in luxury properties that are rated four and five stars increased 16%, the slowest of the three quality segments tracked by CoStar. This slower rent growth in luxury property reflects the fact that a majority of the new supply that has inundated some U.S. multifamily markets consists of properties rated four and five stars, resulting in heightened competition for renters.

Public multifamily REITs have reported in quarterly earnings calls and investor presentations that their luxury portfolios see high-income households spend only about 20% of their gross monthly income on rent. Not only have luxury renters seen the lowest rent increases over the past four years, but these households are also able to absorb rental increases much easier than households at lower income levels.

Tampa, Florida, a market that had some of the strongest rent growth during the pandemic, shows an even more challenging situation for mid- to low-income renter households. Mid-priced, three-star properties in Tampa increased on average 34%, or $402 per month, since the end of 2019. Rental households rated one and two stars in Tampa had to deal with a 29% jump in rents, increasing their monthly housing outlay by $285. At the same time, luxury properties saw the slowest increase, at 27%.

Luxury rentals nationally have recently seen year-over-year rent growth fall as new supply additions outpace demand, easing rent growth increases for the highest-income renter households. However, given the minimum levels of new supply outside the luxury price point, mid- and low-income renters have not benefited from tempering of rent growth.