The U.S. multifamily property market is facing an inflection point, with concerns about a slowdown after years of strong performance. While some markets are enjoying gains, others are facing challenges, and the sector as a whole is in a state of flux. Moderating pandemic-triggered migration, increased supply and rising construction costs are among the factors that may impact the market moving forward. Keep reading for a closer look at the current state of this key property sector and the challenges and opportunities it faces in the year ahead.

The obligatory caveat states: Past Performance may not guarantee future results. Multifamily properties approach 2023 with concerns about an inflection point where the stellar results enjoyed in recent years come back to earth. If the economy generally faces an uncertain future – hard landing or soft? – the apartment sector presents investors with a similar dilemma.

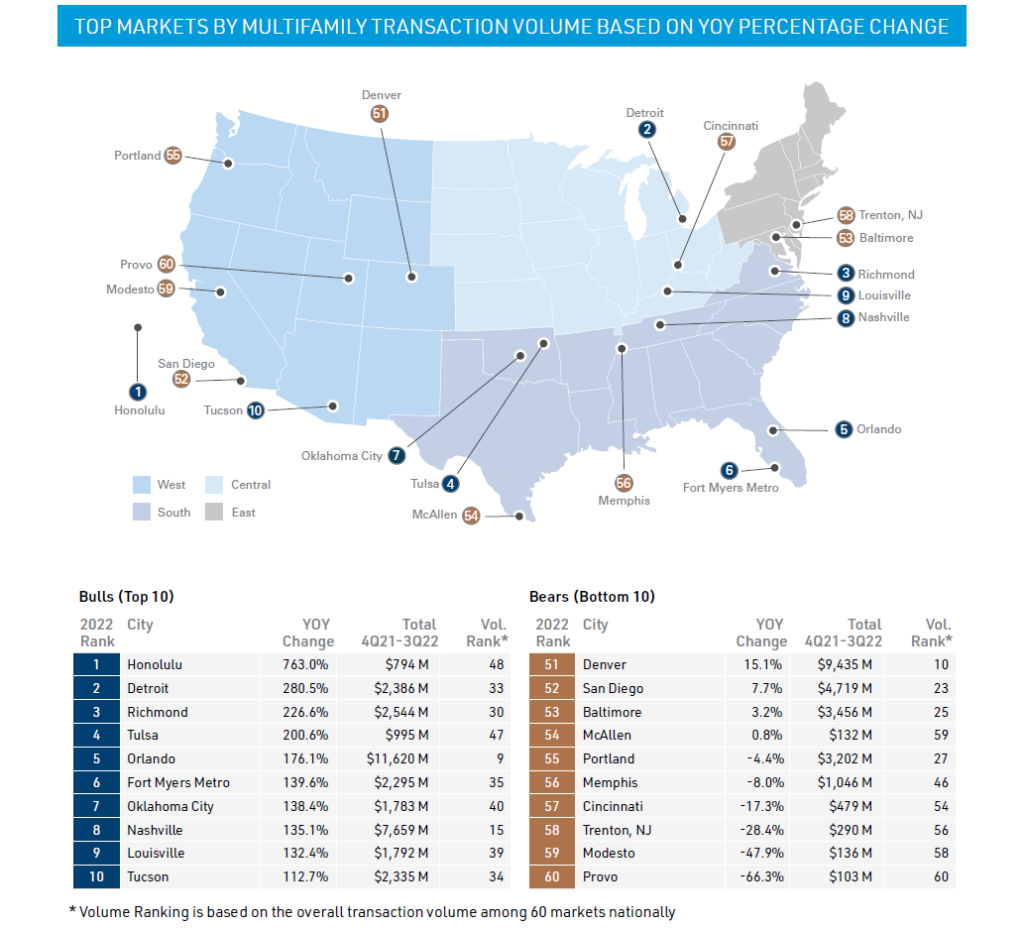

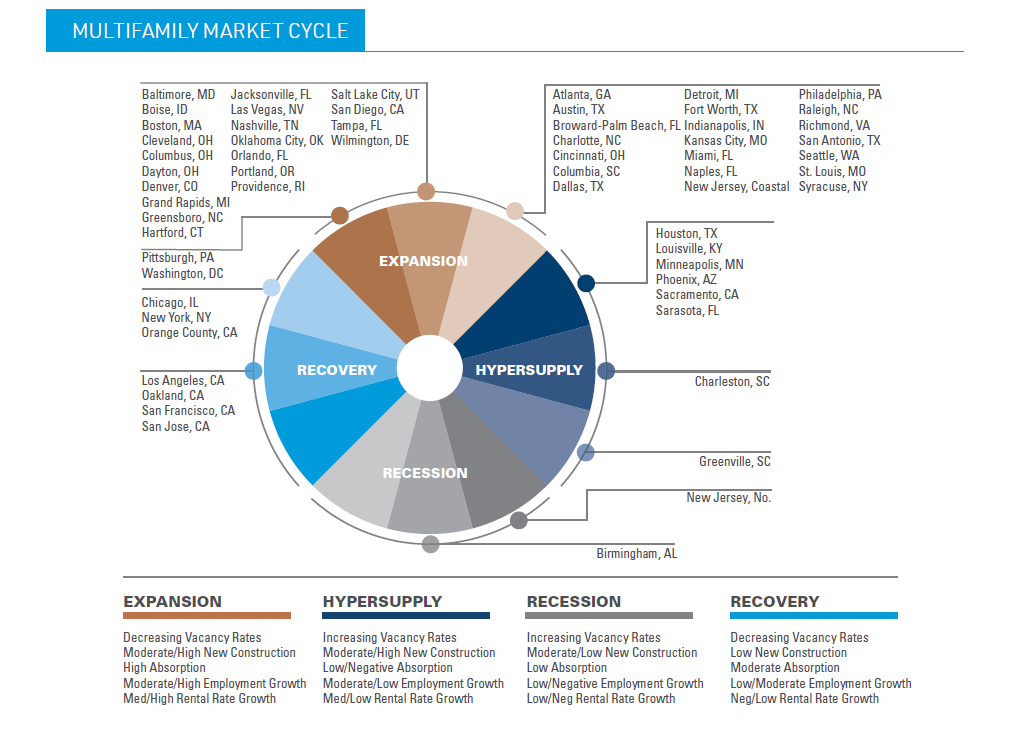

Many markets are reveling in the gains in multifamily market conditions. This year’s Market Cycle Chart tells the story vividly. Only 10 markets are categorized as being in recession or hyper supply, versus 51 markets in recovery or expansion. Notably, none of the often-cited rationales for market strength or weakness explains the patterns of performance. Large cities (New York, Los Angeles, Chicago) are joined by smaller ones (Boise, Providence, Kansas City) in the group of improving apartment markets. Southern cities (Nashville, Jacksonville, San Diego) are in the cluster of expansion markets, but so are markets in the northern tier (Cleveland, Philadelphia, Seattle). Sprawling metros like Atlanta and Dallas score well, but so do more traditional urban core cities like Boston and San Francisco. More negatively, what would explain the hyper supply rating shared by Houston and Minneapolis? Or the recession being simultaneously observed in Birmingham and in northern New Jersey?

Perhaps the safest thing to say is that multifamily is facing a time of flux, but its starting point as we turn into 2023 is rather enviable.

To some degree, apartments need to be considered in the broader context of the ownership housing market. As discussed earlier in Viewpoint 2023, the soaring cost of single-family homes inflated by historically low mortgage rates has squeezed affordability for millions of potential homebuyers. This theoretically shifts demand into the rental market, which accounts for 35% of U.S. households. Rising mortgage rates raise the bar of comparison for the rent vs. own choice, and has been encouraging a surge in multifamily rents.

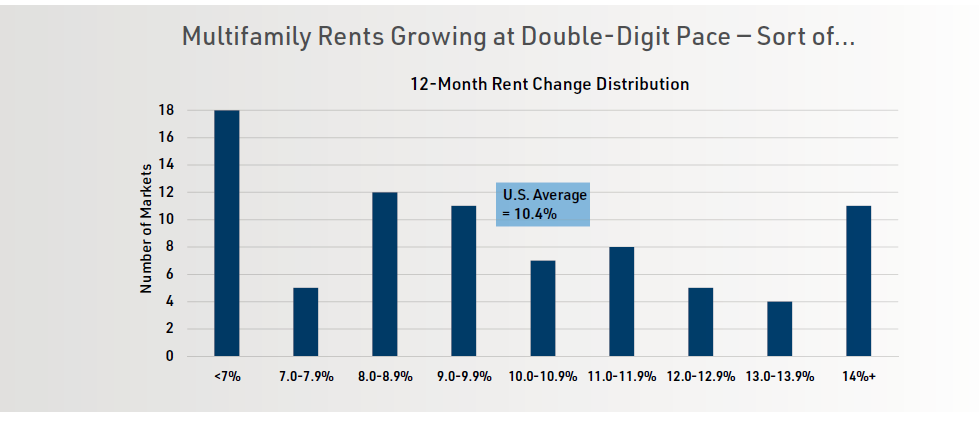

Moody’s Analytics calculates that the average rent increase, nationwide, from third quarter 2021 to third quarter 2022 was a stunning 10.4%. But, as the graph showing the distribution of rent growth by market suggests, there are very few “average” markets in the country. Only seven markets show rent gains approximating ten percent: Columbus, Denver, Indianapolis, Orlando, San Francisco, San Jose, and Tampa. Twenty-four markets register rent increases between 7% and 10%, while only 15 markets see apartment rents up between 11% and 14%. Taking the extremes into account (<7% or >14%), the asymmetry becomes even more dramatic. The takeaway? A slowdown in this sector is already underway, and a further decline in momentum is probable in 2023.

What has changed? Let’s start with the unusual surge of migration that was triggered in the early months of the pandemic. That adjustment has run its course, but many in the real estate community extrapolated its pace into a sustained trendline. Now that some seriously impacted markets – especially Manhattan – have seen a return of renters (Moody’s data shows a 3.5% vacancy rate and a 19.6% rental growth rate for New York), the “flight to Florida (or the Hamptons, or to the Carolinas)” expectations have moderated.

Then, too, there is the issue of new supply. Suburbdominated metros with ample land at their perimeters have enjoyed robust new construction. Through early 2022, demand for both single-family homes and rental apartments grew nicely apace with development. Inflation and rising interest rates have decoupled late 2022 demand (and likely 2023 demand) from the housing construction pipeline, though.

CBRE construction analysts are pegging the growth in construction cost at year-end 2022 as 14.1%, with other experts from Skanska, Lend Lease, and CORFAC confirming double-digit cost acceleration. Supply chain disruptions (not over yet, as witness the impacts of the late 2022 China shutdown and continued effects of the war in Ukraine), as well as a construction labor shortage now moving into its second decade are the primary villains on the cost side.

As for demand, simply put, there is little good news for new housing in a potential recession and decelerating employment statistics. Layered atop this are some generational statistics worth contemplating. The Census Bureau reports that 58% of young adults (aged 18 to 24) are living with their parents. Moreover, according to analysis from Pew Research, 25% of those aged 25 to 35 reside in multigenerational households, mostly with their parents. Here is one place where the economic impact of student debt intersects with the vitality of real estate demand – to the industry’s detriment.

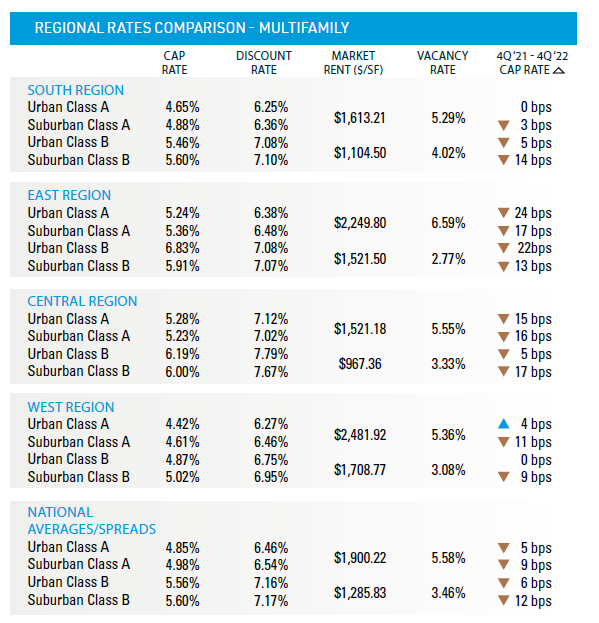

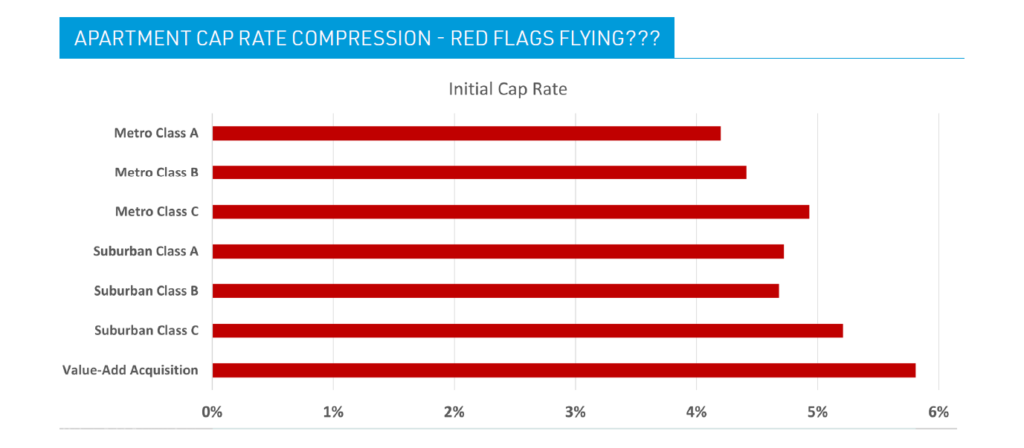

Taking such factors into consideration, cap rates for apartment properties in the fourth quarter 2022 seem to face an inevitable rise – with negative effects on transaction flows and prices in 2023. Not only do we see multifamily cap rates ranging between 4.4% and 6.8%, which are very compressed when compared with the riskfree Treasury rates, but the adjustment year-over-year in cap rates – ranging from zero basis points to an increase of just 24 bps – is simply too inelastic: a sign that the “past performance” disclaimer has not yet been taken to heart in the apartment investment community.

Bureau reports that 58% of young adults (aged 18 to 24) are living with their parents. Moreover, according to analysis from Pew Research, 25% of those aged 25 to 35 reside in multigenerational households, mostly with their parents. Here is one place where the economic impact of student debt intersects with the vitality of real estate demand – to the industry’s detriment.