As seen in CoStar

Total $19.8 Billion in First Quarter the Smallest Since 2020, CBRE Says

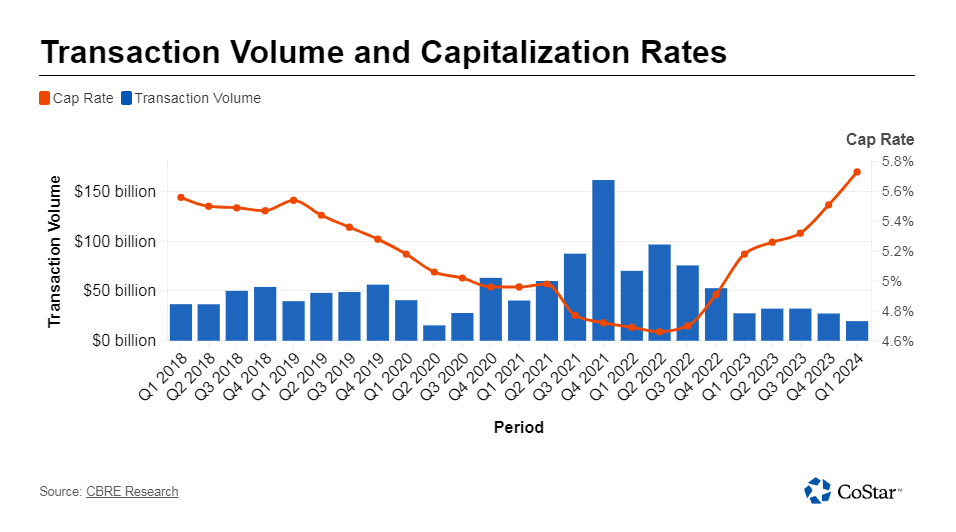

Total multifamily investment in the first quarter fell to $19.8 billion, according to a new report from brokerage CBRE, the smallest quarterly total since the pandemic-slowed second quarter of 2020.

Investment in the past quarter represented a 28% decline from the final quarter of 2023, and a nearly 88% drop from peaks in the fourth quarter of 2021. Data from CoStar shows a similar trend, with investment totals from the first three months of 2024 sliding 24% quarter over quarter and 86% from highs in 2021.

On a rolling four-quarter basis, investment volume in the last three quarters of 2023 and the first quarter of 2024 fell 50% to $11.7 billion, the lowest four-quarter total since the year ended in the third quarter of 2014, according to CBRE.

Declines in investment — reflected in the first-quarter earnings of some of the nation’s largest apartment owners — come as buyers and sellers find it difficult to agree on pricing.

Increases in capitalization rates have also accelerated, translating into lower property values. These measures of investment yield signal risk, too, with high rates indicating a weaker prospect of returns.

Cap rates in the first quarter reached 5.7%, a 20-basis point increase from the fourth quarter and 100 basis points higher than the most recent low in the second quarter of 2022 when the Federal Reserve began raising interest rates, the report said.