Over the past decade, the price-per-unit (PPU) for multifamily properties surged 156 percent, reaching nearly $160,000. This increase surpassed both median home sale prices and rental rates.

The latest CommercialSearch study compared and ranked the most active U.S. metros in terms of multifamily sales since 2009.

Here are some highlights:

- Denver is the fifth hottest U.S. market for multifamily sales over the last decade. Since 2009, Denver registered more than $46B in multifamily sales.

- In terms of transactions, 1,192 deals were completed across the metro since 2009, totaling 274,467 units.

- In 2020 alone, Denver closed 73 deals, claiming the 5th spot.

- For comparison, nationally, the average rent saw a 37% increase to $1,462 and the median home sale price was up roughly 58% since 2009 to $313,200.

Denver Economy

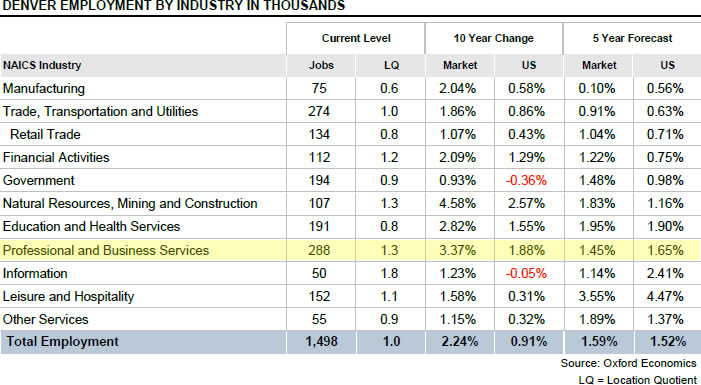

Denver’s emergence as a bona fide technology market this cycle has helped insulate it from the impact of the coronavirus-induced downturn. Tech employers typically allow the flexibility of telecommuting, and many officeusing employers have the capacity to facilitate a workfrom- home transition. Office-using jobs in Denver have grown above the national average the past five years at about 3% annually.

Even though Denver’s overall employment growth showed signs of a slowdown last year along with the national index, it added tech jobs at an accelerating pace. Employment in Professional, Scientific & Technical Services grew by more than 7% annually in 2019, one of the best growth rates in the country. Corporate expansions and relocations by tech companies such as Amazon, Slack, and Conga drove employment gains and epitomize the trend of West Coast firms choosing to expand in Denver for its robust workforce, quality of life, and cost of doing business.