As seen in CoStar

Sales volume increases 62% from 2023 levels

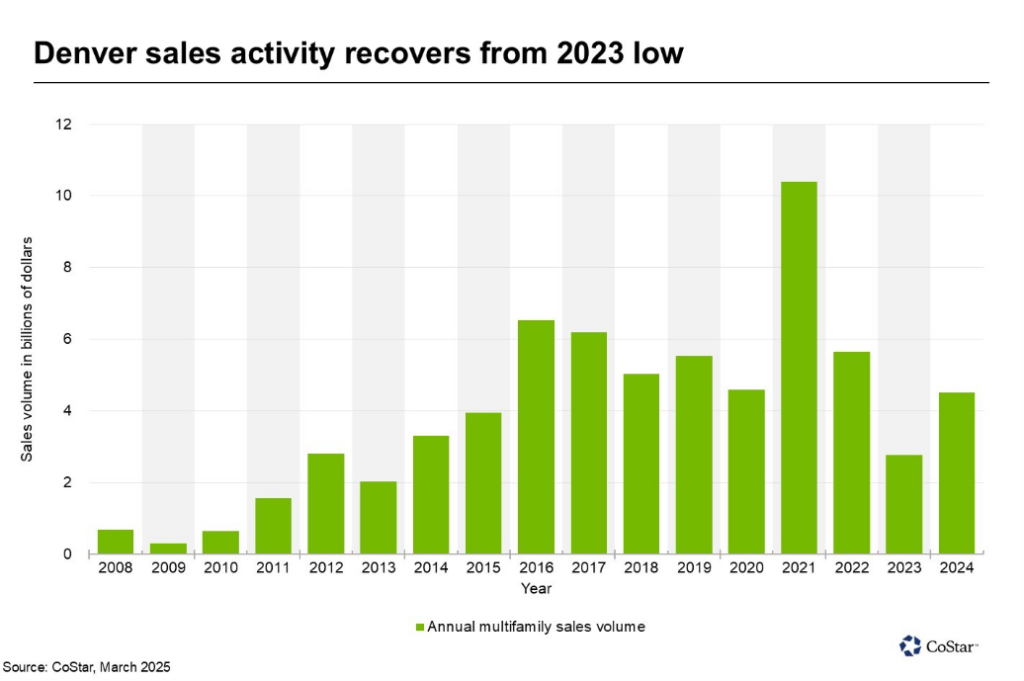

After hitting a decade low, multifamily investment sales in the Denver area rebounded in 2024 as an increase in apartment demand boosted sales volume across the region.

Roughly $4.5 billion in multifamily deals traded hands last year, according to CoStar data. This comes after a tepid 2023 when just $2.7 billion was invested, marking the lowest annual figure dating back to 2013.

The recent momentum underscores investors’ willingness to look beyond short-term hurdles created by the high cost of capital and construction boom and focus on the market’s ongoing demand for housing.

The Denver market added nearly 31,000 people between July 2023 and July 2024, marking the strongest year-over-year population growth recorded since the onset of the coronavirus pandemic. Population for the 10-county metropolitan area now totals 3.05 million, according to new estimates from the U.S. Census Bureau. Population growth helped boost apartment demand and increase investor appetite in the Denver market.

In total, 227 properties traded in 2024, including 13 that closed with a sales price above $100 million.

The average sale price in Denver ended 2024 at $304,000 per unit, above the national benchmark of $226,000 per unit, according to CoStar data. However, this is down from Denver’s record high of $368,000 per unit, which was achieved in mid-2022.

While the vacancy rate of 11.1% remains near historic highs, vacancy likely peaked in the fourth quarter and is now on a downward swing due to a combination of higher levels of demand and a slowdown in construction. Apartment completions are expected to fall dramatically in 2025 with 8,500 units projected to be completed this year, down from 18,000 units in 2024.

Barring any significant economic shift to the downside, the local apartment market’s healthy demand and slowdown in construction activity should keep investors interested in the near term.