As seen in CoStar

Despite Strong Tenant Demand, Robust Construction Pipeline Curbs Rent Growth

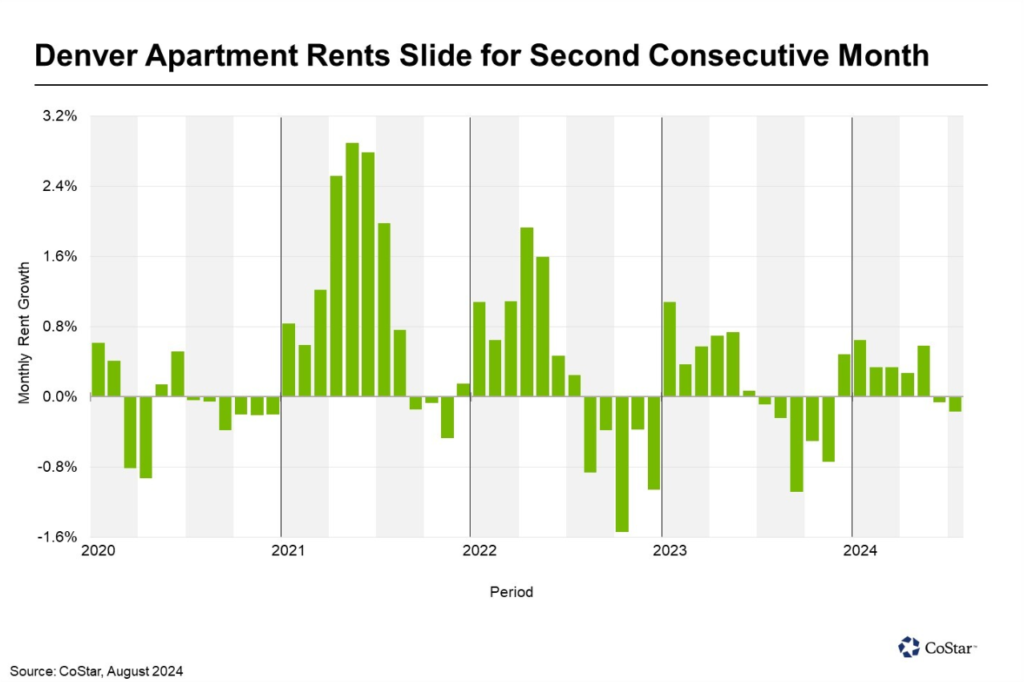

Apartment rents in Denver fell by 0.1% in July, marking the second consecutive month of declining rent growth as the region digests a historic construction wave.

A strong spring leasing season resulted in modest rent gains through the first five months of the year, a notable accomplishment for property owners given the sheer number of units completed over this timeframe.

However, owners were unlikely to hold on to these gains, as a wave of new units continued to be added to the market. That coincided with a seasonal slowdown in demand that typically takes hold in late summer and lasts through the winter months.

The average asking rent for a one-bedroom apartment in Denver is now $1,872 per month, according to CoStar data — up by nearly 2% from the start of the year.

Annually, rents have increased by just 0.5%, placing Denver in the bottom half of major U.S. markets and lagging the national average of 1.3%. This represents a stark change from the demand surge in 2021 when annual gains exceeded 11%.

Property managers report that concessions have become necessary to secure leases, particularly in high-construction areas like Downtown and East Denver. Roughly 38% of properties offered incentives, such as a month’s free rent, in July, up from 17% the previous year.

However, there is light at the end of the tunnel. Completions are expected to drop off by 2025, which should support stronger rent gains. Rents will exceed 4% by year-end 2025, CoStar forecasts, marking a return to historic averages.