Seasonality, Looming Recession Fears and Robust Pipeline Affect Rents.

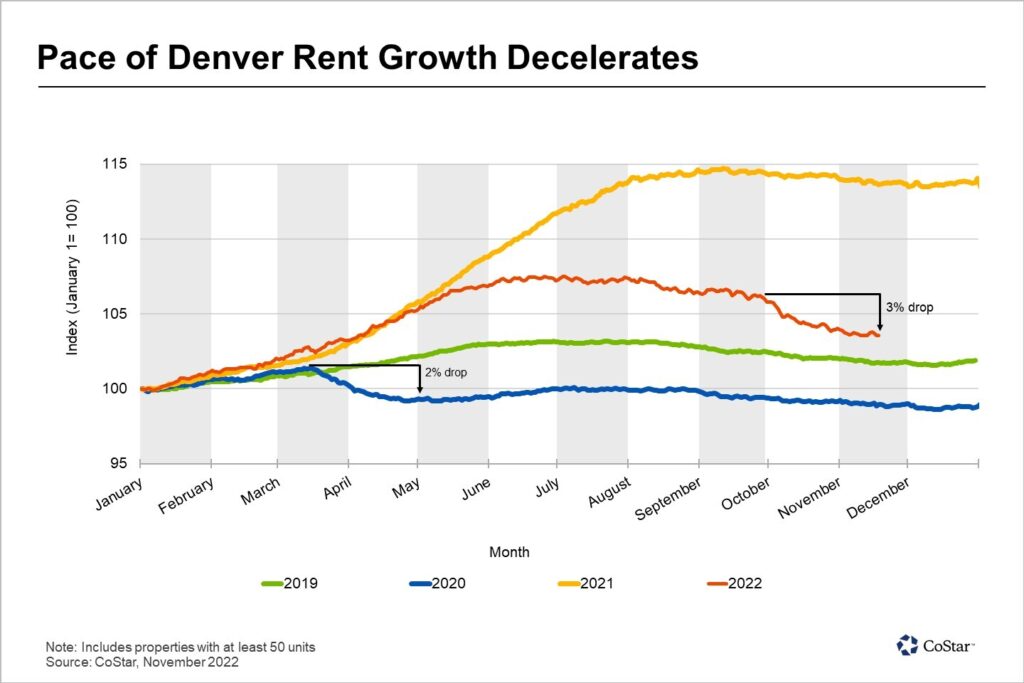

Average asking rents are retreating across the Denver multifamily market at a faster pace than what was experienced during the early days of the coronavirus pandemic. Denver rent growth contracted by roughly 3% in properties with over 50 units since the beginning of October, according to CoStar’s Multifamily Index, powered by Apartments.com. That is a faster pace than the 2% drop recorded while the city was on lockdown in 2020.

Seasonality is at play, as apartment demand typically slows during the fourth quarter. Renters are more reluctant to move during the colder months, with many resuming their hunt for an apartment after the holidays. But this year, seasonality is being compounded by an uncertain economic outlook and a daunting construction pipeline.

New construction outpaced demand in four out of the last five quarters, pushing vacancies up by a full percentage point in the last year to 6.8%. Supply-side pressure is expected to continue, and with 25,000 units in the pipeline, vacancies in Denver are projected to climb another 2 percentage points by 2024, ultimately peaking at 8.8%.

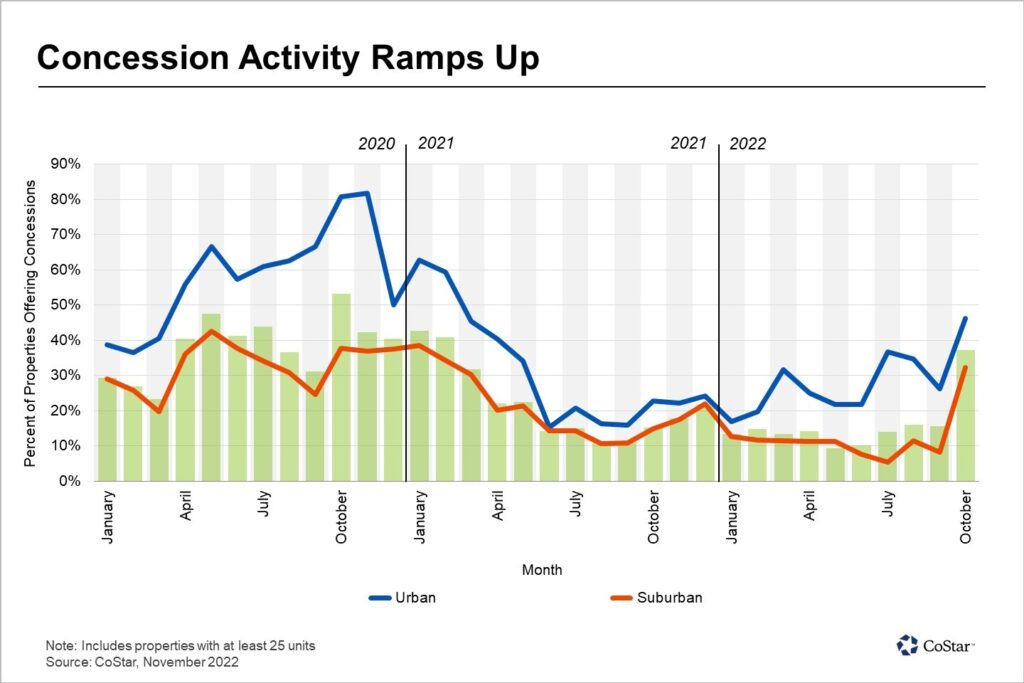

Landlords are responding to the shift in market dynamics. Concession activity rose sharply in October, with 37% of properties with at least 25 units offering some form of incentive. That is up from just 15% in September.

Concession activity has consistently trended higher in downtown relative to the suburbs since the start of 2020. Incentives such as a month of free rent are typically only offered in new, luxury projects during the lease-up phase, and these developments have been concentrated downtown in recent years. But concession activity also spiked in the suburbs in October, indicating that even stabilized apartment buildings are beginning to use concessions as a tool to drive demand.

Landlords will likely need to lean heavily on concessions during the typically slower months ahead to meet occupancy goals. CoStar’s base case forecast calls for rents to pick up again in 2023, ending the year with 3.7% growth. Even as rents are projected to rise next year, concession activity is expected to remain robust with a historic amount of new supply scheduled to come on line.