As seen in CoStar

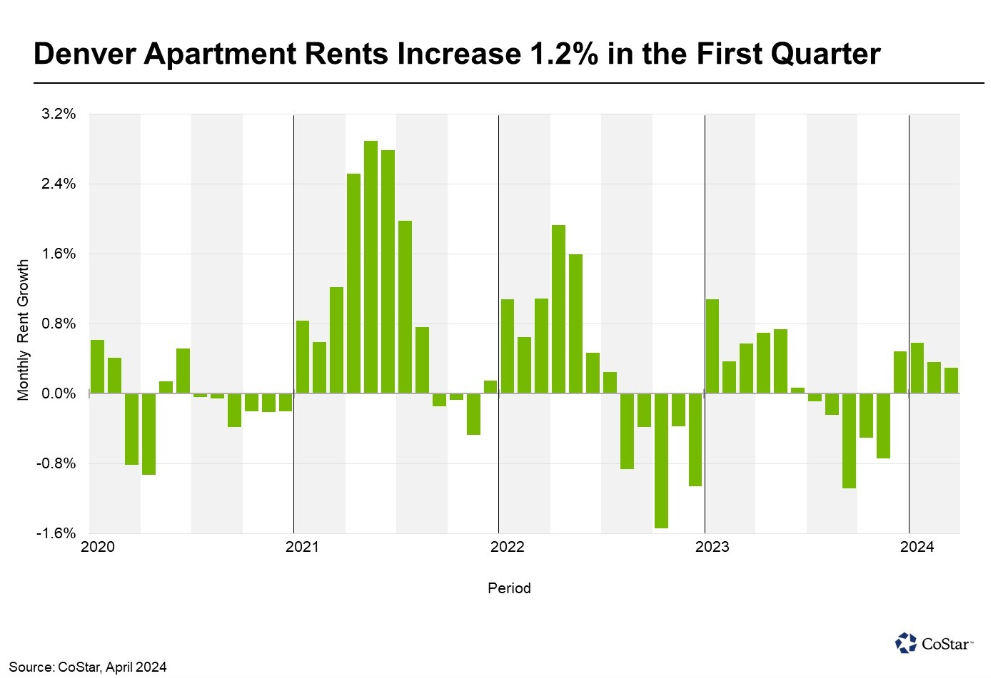

Rents increased 0.3% in March, according to CoStar data, marking the fourth straight month of rising apartment rents in the Mile High City. Rents rose 1.2% overall in the first quarter.

The positive rent growth figures are tied to a rebound in apartment demand. Net absorption, or the total of move-ins minus move-outs, amounted to 2,250 units in the first quarter, the highest figure dating back to the second quarter of 2022.

The average apartment rent in Denver is now $1,849 per month, up from $1,823 per month at the start of the year.

Pent-up demand for middle-tier apartments is driving rent growth in the market. Easing inflation and improved consumer sentiment have made potential new renters at this price point more confident in signing an apartment lease. The average asking rent for a three-star apartment in Denver is now $1,656 per month after rising by 1.5% in the past year.

The high-end four- and five-star properties, on the other hand, have struggled to generate positive rent growth. While these properties at the top end of the market consistently account for the bulk of net absorption, oversupply conditions continue to weigh on landlords’ ability to push rates.

While concessions remain elevated, they did begin to ease in the past month. About 25% of properties offered free rent or other concessions in March, down from about 30% at the start of the year. Renters are most likely to find concessions in new construction apartments during the lease-up phase, where four to six weeks of free rent has become standard.

Continued high levels of demand will be needed to support further rent gains in 2024. Over 8,000 units are scheduled for completion through the remainder of the year on top of the 3,600 units that were added in the first quarter. New units added to the market are expected to keep the vacancy rate north of 9%, the highest vacancy recorded in more than 20 years.