As seen in CoStar

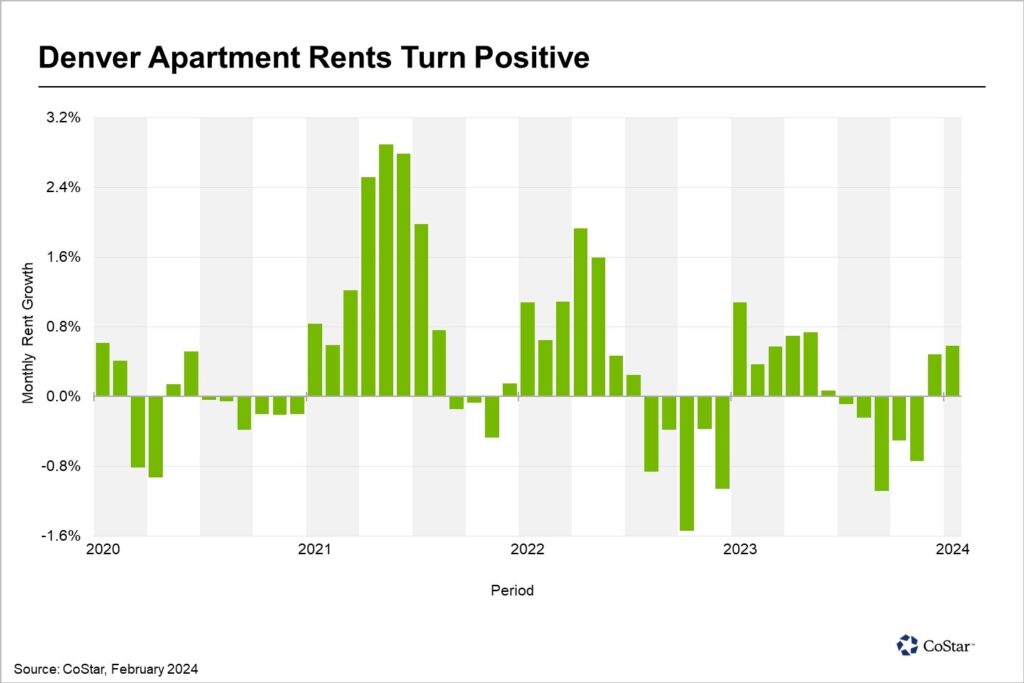

Rents Increased in January for the Second Month in a Row

Apartment rents are on the upswing in Denver, increasing by a full percentage point over the past two months.

Net absorption, or the total of move-ins minus move-outs, amounted to 2,300 units in the fourth quarter of 2023, marking the best quarterly performance dating back to mid-2022. This was an encouraging sign for local property managers, as the last three months of the year typically represent the slowest leasing season with most renters putting off moving until after the holidays.

Landlords responded to the rebound in demand, raising asking rents by 0.4% in December and 0.6% in January, according to CoStar data. The average rent for a one-bedroom apartment in Denver is now $1,831 per month, up from $1,817 from the year prior.

However, concessions are not reflected in these rent figures. About a third of properties across the market are offering some form of incentive for new leases, up from about 20% at the start of 2023. The increased use of discounts, such as a month of free rent, could mean that effective rent levels are still falling. Renters are most likely to find concessions in new construction apartments during the lease-up phase, where four to six weeks of free rent has become standard.

Demand will need to remain elevated to support further rent gains in 2024. Over 12,000 units are scheduled to be completed this year, a record for the Denver market. New units added to the market are projected to push Denver’s vacancy rate up above 9% by year-end, which would mark the highest vacancy recorded in more than 20 years.

The luxury four- and five-star segment makes up nearly 80% of units scheduled to be completed in 2024, and these properties will be most affected by new supply hitting the market. Vacancy in this segment is projected to peak around 11.5% at the mid-year point, when the bulk of projects are scheduled to come on line. However, groundbreakings have slowed to a crawl since early 2023.

The luxury segment could find relief from supply-side pressure as early as the second half of the year when demand is projected to outpace new supply.