As seen on Multi-Housing News

Top Western Markets by Investment Activity

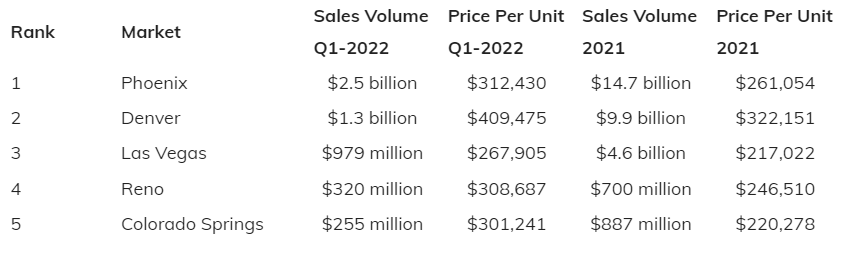

U.S. multifamily investment has been riding a wave of expansion and despite ongoing global issues, the sector’s steam is still holding up. With the country’s economy contracting 1.4 percent in the first quarter of 2022 due to multiple reasons, such as inflation, supply-chain issues and the ongoing pandemic, Yardi Matrix is expecting the deceleration of this growth.

Nationally, asking rents increased by $34.0, up 2.1 percent in the first quarter—a record increase for the first three months of a year. The heightened demand in the Sun Belt and the West has started to show signs of cooling off. Year-over-year occupancy rates through March have decreased in four metros in the U.S., led by Phoenix (-0.5 percent) and Las Vegas (-0.4 percent).

The list below highlights the top Western markets which recorded the largest transaction volume in the first quarter of 2022, based on Yardi Matrix data. In the same period, prices have gone up in all of the markets mentioned here, compared to 2021 levels.

5. Colorado Springs, CO

Across Western markets, Colorado Springs has registered the fifth-largest sales volume in the first quarter of the year, with a total of $254.9 million transacted in the first three months. By comparison, in the same period in 2021 the volume reached $230.7 million.

The second-most populous city and the most extensive city in the state of Colorado has seen a healthy increase of population, gaining more than 100,000 residents over the past decade, according to 2020 U.S. Census data. Between February 2020 and the same month in 2022, Colorado Springs added 13,844 new jobs, according to Bureau of Labor Statistics data.

The largest transaction in the metro’s multifamily investment market recorded by Yardi Matrix was the $97 million sale of a 12-building garden-style community in Monument, Colo. A private owner sold the 267-unit Vistas at Jackson Creek property to an affiliate of Equus Capital Partners.

4. Reno, NV

One of the top emerging multifamily markets in the country, Reno registered a 15.3 percent population increase between 2010 and 2020, according to U.S. census data. The city’s unemployment rate as of February 2022 reached 2.8 percent, below the rate registered two years ago, when in stood at 2.9 percent. During that same period, the labor force grew by 7,443 persons.

In the first quarter of the year, multifamily investment volume in Reno reached $319.8 million, significantly higher than the $252.7 million recorded in the first three months of 2021. The total sales volume last year reached $700.1 million, nearly double the total volume recorded in 2020.

Prices in Reno have increased significantly in the last two years—while the average price per unit reached $214,661 in 2020, that figure increased to $246,510 in the following year. As for the first quarter of 2022, the average price per unit clocked in at $308,687, considerably higher than in the first three month of 2021.

3. Las Vegas, NV

In the first quarter of 2022, multifamily sales in Las Vegas reached $979.5 million, the third highest among the Western markets listed here. In 2021, a total of $4.59 billion of multifamily product transacted in Las Vegas. Even though the metro’s unemployment rate has been shrinking since hitting a record high in April 2020, the rate hasn’t yet returned to pre-pandemic levels. In February 2022, unemployment reached 5.3 percent, 1.8 percent more than two years prior. Las Vegas led the nation for year-over-year job growth as of December 2021, reaching 8.8 percent.

Out of the top five Western markets listed in this article, Las Vegas was the least pricey, reaching an average price of $267,905 per unit in the first quarter of the year. Prices were low in 2021 and 2020, averaging at $217,022 and $169,899, respectively.

Logan Capital Advisors made one of the biggest purchases in the first quarter of the year, with the $97.5 million buy in in the Summerlin/Spring Valley area of Las Vegas. The seller, Griffin Capital, purchased the 220-unit South Beach Apartments community in 2018, for $62 million.

2. Denver, CO

Despite omicron- and economy-related woes, Denver’s recovery is still underway and should continue through 2022. As of March, the metro’s rent growth year-over-year reached 14.1 percent, while the forecast year-end rent growth was 6.4 percent, according to Yardi Matrix.

The metro’s sales volume in the first quarter of the year clocked in at $1.32 billion, the second highest figure on our list, while also reaching the highest price per unit in that period, $409,475. The total multifamily sales volume in Denver during 2021 reached $9.96 billion, while the price per unit that year was also the highest among the five markets, averaging at $322,151.

As of February 2022, Denver’s unemployment rate reached 4.0 percent, its lowest point in the last two years, since March 2020, close to the national average of 3.8 percent that month.

In January, MG Properties Group closed on one of the biggest purchases in Denver, recorded during the first quarter of the year. The company picked up the 564-unit 3300 Tamarac Apartments for $141 million from Gelt Inc. The buyer backed the purchase with a $91.7 million Fannie Mae loan.

1. Phoenix, AZ

Phoenix has become one of the hotspots of commercial and residential development in the past year, recording exceptional growth on all levels. The metro’s multifamily investment volume in the first quarter of 2022 amounted to $2.53 billion, outperforming Denver’s figure by more than 92 percent. In the same period, Phoenix registered the second-highest price per unit on the same list, reaching $312,430.

Through 2021, Phoenix’s multifamily market has seen the transaction of multifamily product worth $14.76 billion, more than double the deal volume in 2020. As of November 2021, rents rose by 25.9 percent on a year-over-year basis, to $1,607, surpassing the U.S. rate, which marked a 13.5 percent increase to $1,590.

The metro’s unemployment rate reached 3.1 percent in February 2022, down 1.2 percent from the figure provided by BLS in the same month of 2020. During those two years, employment also increased by 91,810.

At the beginning of March, Tides Equities—one of the most active players in the market during 2021—teamed up with CIM Group for the purchase of a 1,012-unit property in Phoenix. The partnership acquired Del Mar Terrace in an off-market transaction for $255 million from the original developer, Heers Development.