With Renters ‘Chasing Fewer Apartments and Fewer Homes,’ Pricing Power Shifts Toward Landlords

By Cara Smith-Tenta

CoStar News – July 20, 2021 | 12:25 P.M.

Apartment owners and landlords in major U.S. cities are increasingly raising the rent.

In 44 of the 50 largest U.S. cities, rents reached record highs, with three cities recording year-over-year rent growth steeper than 20%, according to a report from Realtor.com, an online real estate listings database that gets its apartment listings from CoStar Group subsidiary Apartments.com.

Nationally, the median rent increased 8.1% year over year to a record high of $1,575 per month, according to the report. Though various factors drive these rent hikes, one major issue at play is the national housing shortage, said David Kahn, director of market analytics for CoStar Group in Atlanta.

“You have people chasing fewer apartments and fewer homes, and that just increases pricing power,” Kahn said.

The U.S. faces a gap of 5.5 million to 6.8 million housing units of all kinds, including rental apartments, rental houses, for-sale houses and affordable rental units, according to a separate study that Rosen Consulting Group conducted for the National Association of Realtors.

The Realtor.com report confirms a CoStar Group analysis from earlier this year that national apartment rents aren’t just recovering from the pandemic — they’re growing at a pace that would equate to the strongest apartment rent gains this century if maintained throughout 2021. One-bedroom apartment rents grew just under 4% in the first four months of this year, according to CoStar. Typically, analysts would have expected apartment rents to be up roughly 1.7% through April, making the rent growth of early this year more than double the normal seasonal trend, according to the analysis.

According to the most recent report, Sun Belt cities led the nation in rent growth. Memphis, Tennessee; Tampa, Florida; and Phoenix all posted year-over-year rent gains of more than 20%, according to the report. And the Inland Empire, a global shipping and logistics hub near L.A., also saw its average rent grow more than 20% year over year.

Between the second quarter of 2020 and the second quarter of 2021, the average asking rent in Memphis grew from $986 per month to $1,007, according to CoStar research. Monthly rents over that same time in Tampa grew to $1,497 from $1,262, and in Phoenix to $1,408 from $1,191, according to CoStar.

Remote Work Shift

While those cities experienced roughly the same degree of rent growth, they benefited from different demographic drivers. The three Sun Belt cities saw their populations increase as renters left larger gateway cities for more affordable but still well-developed cities. Meanwhile, the Inland Empire largely benefited from its proximity to L.A. and saw its population swell as scores of L.A. residents moved to the region, one of the city’s cheaper outlying areas, during the pandemic, Kahn said.

“They really benefited from remote work,” Kahn said of the Inland Empire.

It’s important to note that this rent hike comes at a vulnerable time for millions of Americans who are finally getting their heads above water in the wake of a pandemic that leveled business markets and acutely affected lower-wage workers.

In addition to the housing shortage, there’s also been growing demand for larger apartments after the pandemic left most Americans quarantined in their homes and feeling confined. And many white-collar renters are more willing to pay higher rent thanks to the money they saved during 2020 by canceling their vacations and forgoing concerts and pricey restaurants.

“There are a lot of savings out there, and people have enjoyed the spoils from the fiscal stimulus,” Kahn said.

A CoStar analysis from early July found that high demand for apartments, combined with a potential slowdown in new supply, could keep pricing power in the hands of multifamily owners in some cities. Rents are up equally in suburban and downtown areas, a notable turnaround for downtown properties that were more acutely challenged by the pandemic.

Kahn predicts the U.S. will experience strong economic growth for the next year or two, which could affect rents in several ways. It could help more current renters enter the for-sale home market, or it could exacerbate apartment demand and raise rents further. But the astronomical growth won’t last forever.

“Things are going to moderate,” Kahn said. “But, until we build more units, [rent growth] could be strong relative to pre-COVID growth.”

Yardi Matrix National Multifamily Report | June, 2021

Multifamily Rent Growth Reaches Unprecedented Levels

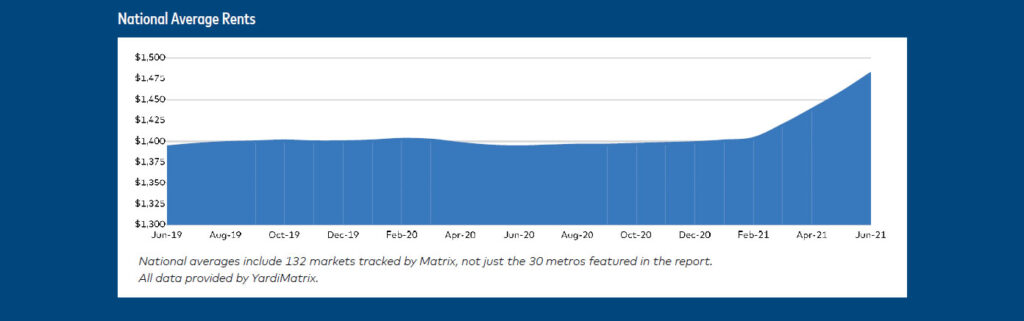

- Multifamily asking rents increased by a whopping 6.3% on a year-over-year basis in June. This is the largest YoY national increase in the history of our data set.

- Rents grew an astonishing $23 in June to $1,482—another record-breaking increase. Lifestyle rents are growing at a faster pace than Renter-by-Necessity rents, something we have not seen since 2011 and another sign of a hot market.

- Single-family (Built-to-Rent) rents grew even faster, at an 11% year-over-year pace.

- To be clear, the increases represent growth in what landlords are asking for unleased apartments. Increases are smaller for tenants that are rolling over existing leases.

A slew of factors has pushed asking rent growth across the country to levels not seen in decades.

Migration is pushing up rents in Southwest and Southeast metros like Phoenix (17.0%), Tampa and the Inland Empire (both 15.1%), Las Vegas (14.6%) and Atlanta (13.3%). These metros were lower cost compared to larger gateway metros, but with double-digit rent increases, the affordability of these metros has begun to decline.

During the last year and a half, the unprecedented amount of government stimulus has helped to boost the economy. Stimulus checks, enhanced unemployment benefits and more than $45 billion of direct renter payments has helped to prop up the multifamily industry. All of this stimulus led to consistent levels of collections across the country.

Household savings has also increased by more than $2.5 trillion since the beginning of the pandemic due to lockdowns that prevented the ability to spend on travel and other activities.

The hot housing market is another driving force behind the strong gains. The S&P Case-Shiller Index found that home prices are up 14% year over- year through June. Many potential home buyers have been forced out of the market, and in turn, decided to rent an apartment for another year.

Another pressure on the cost of housing is the lack of new supply. The U.S. is on track to build 1.5 million units in 2021, according to the Census Bureau, but that will not be enough to satisfy the demand for housing.

Rent growth will not be able to continue at these levels indefinitely, but conditions for above-average growth are likely to persist for months. National Average Rents National averages include 132 markets tracked by Matrix, not just the 30 metros featured in the report. All data provided by YardiMatrix…

Click Here to Request the Full Report