As seen in Wall Street Journal

A jump in new supply has pushed up vacancy, making it harder for landlords to raise prices.

The apartment rental market finally stopped clobbering tenants with big price increases in 2023. That trend will likely continue in the new year, even as job growth and housing demand remain high in many parts of the country.

Relief for tenants has come from a surge in new supply that has pushed vacancy higher, making it harder for landlords to raise prices. Many tenants have also simply reached the limits of what they are able to pay after years of big rent hikes, housing analysts say.

“Affordability is at a really uncomfortable level for a huge swath of the American population,” said Jonas Bordo, chief executive of rental listings site Dwellsy.

Rents for new leases rose more than 20% during two years spanning 2021 and 2022. That growth moderated last year as rents either barely rose or slightly declined, according to most metrics.

Real-estate firms and data companies are projecting total rent growth in the very low single digits this year. Data provider Yardi Matrix predicts rents will rise 1.5%, while commercial-property firm CBRE estimates growth of 1.2%.

Despite the moderating of increases, the rental outlook remains bleak for many tenants. Last year, affordability for typical renters got worse, as it has every year since the pandemic began.

So-called renters by necessity, a broad cohort of tenants tracked by Yardi, now spend nearly 32% of their income on rent on average. The U.S. Department of Housing and Urban Development considers that share of earnings “cost-burdened.”

For most of the pandemic, landlords reaped huge profits from the double-digit rent increases they charged tenants. When rents were on a tear, owners also benefited from soaring values as investors spent record amounts on apartment buildings.

But that bull run for owners fizzled out last year as rents moderated. Investor appetite also has waned as higher interest rates have driven down values of all types of commercial property.

Sales of apartment buildings were down 68% in November, compared with the same month a year earlier, according to data provider MSCI Real Assets. Prices paid for apartment properties fell 12%.

Investment activity looks unlikely to rebound back to its recent heights, especially if borrowing costs remain high and potential buyers believe buildings still look overvalued.

New apartment supply, especially in large Sunbelt cities, also has damped investor interest while easing rent increases. This year brings more of it.

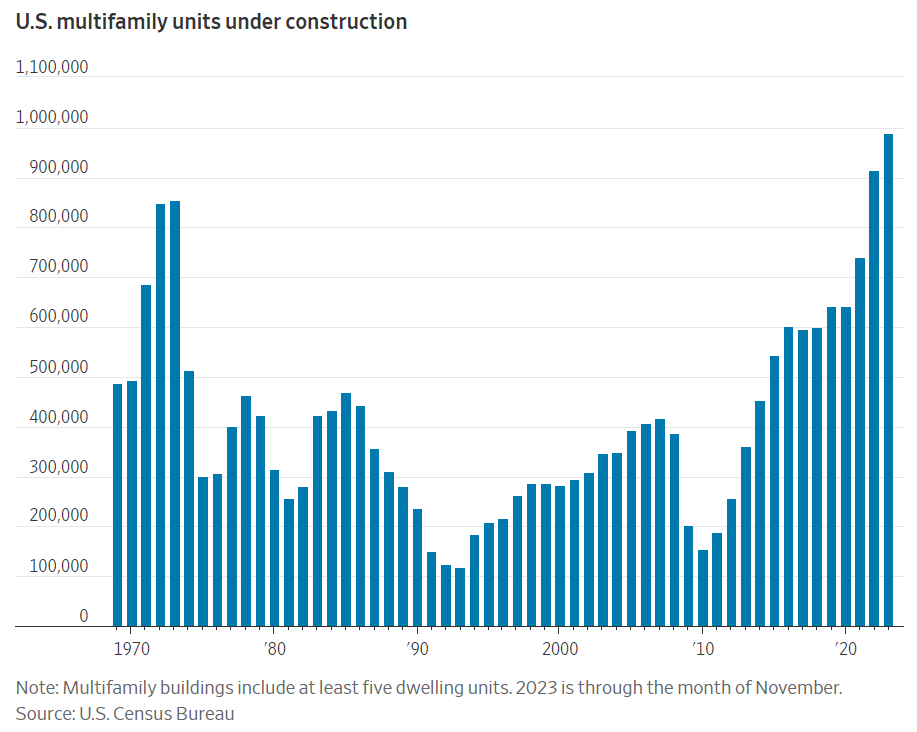

Nearly one million apartment units are under construction, and most of them are set to open during the next 12 months, according to a report from real-estate firm CBRE. Nashville, Tenn.; Austin, Texas; Dallas and Atlanta are among the cities adding the most new units, CBRE said.

Some investors think prices will fall even further this year and are putting off plans to buy buildings. “You don’t want to catch a falling guillotine,” said Marcel Arsenault, CEO of Colorado-based property investment firm Real Capital Solutions.

Arsenault said he expects property values in oversupplied cities could fall another 10% or more this year. His company is preparing to eventually buy about $1 billion in apartment buildings.

Investors are sitting on about a quarter-trillion dollars of so-called dry powder to invest in U.S. commercial real estate, according to CBRE. Targets of that money include debt-laden landlords who bought apartment buildings in recent years and now need cash, as well as merchant builders who need to refinance construction loans, said Daniel Baker, managing director of CBRE’s central multifamily division.

Some in the real-estate industry are optimistic that changes in the broader economy might help spark more investment activity soon. A recent decline in the 10-year Treasury yield has already helped lower the cost of borrowing, and costs could fall further if the Federal Reserve moves to cut interest rates this year, as central-bank Chair Jerome Powell has hinted is likely.

Despite expectations for a so-so 2024 for landlords, demand for rental housing is still described as strong by investors and analysts. That is particularly true for single-family homes for rent, which have been more resilient than apartments.

A challenging market for home buyers is also seen as a tailwind for the home rental business, as prospective buyers, who can’t afford a home or who don’t want to buy at today’s prices and mortgage rates, rent instead.

In New Hampshire, psychiatry professor Karen Fortuna spent her 2020 bidding on homes and losing out to all-cash buyers. Despite her and her engineer husband’s high incomes, the couple gave up on finding something to buy, instead renting a three-bedroom house.

Mice, leaks and a 25% rent increase have since increased the appeal of buying their own house. But high sales prices and low inventory in New Hampshire will keep the couple renting in 2024, Fortuna said. “This is the best option.”