As seen in CoStar

Construction slowdown should bring down elevated vacancy rate

Denver’s apartment construction pipeline has dropped to 2020 levels as developers face difficulties in breaking ground on new projects amid higher construction costs, slower rent growth and a tighter lending environment.

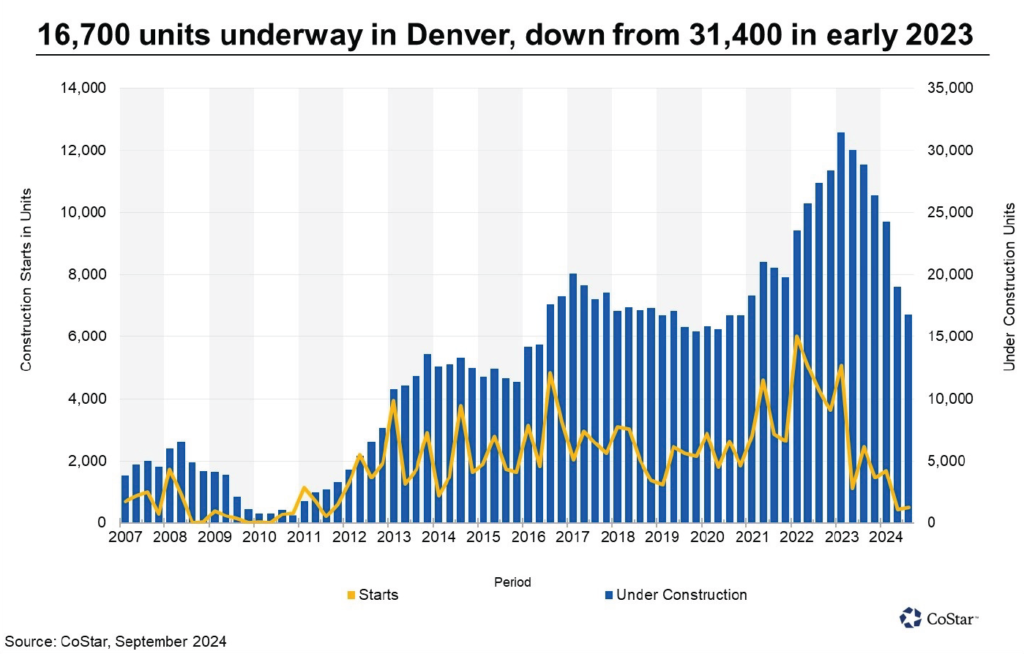

The supply pipeline has essentially been cut in half over the past 18 months, according to CoStar data. Early 2023 marked the height of the current development boom when over 31,400 units were underway, the highest surge in apartment development dating back to the 1980s. The pipeline has steadily dropped for six consecutive quarters to 16,700 units as of the third quarter.

While new projects have been completed quickly, groundbreakings have fallen to a decade low with less than 1,000 units entering the pipeline in the past six months.

It takes an average of 21 months for a new apartment project to go from groundbreaking to the first resident moving in, according to a new CoStar analysis of multifamily construction projects in Denver. That means that for every unit that doesn’t break ground this year, one less unit will be available in the market two years from now.

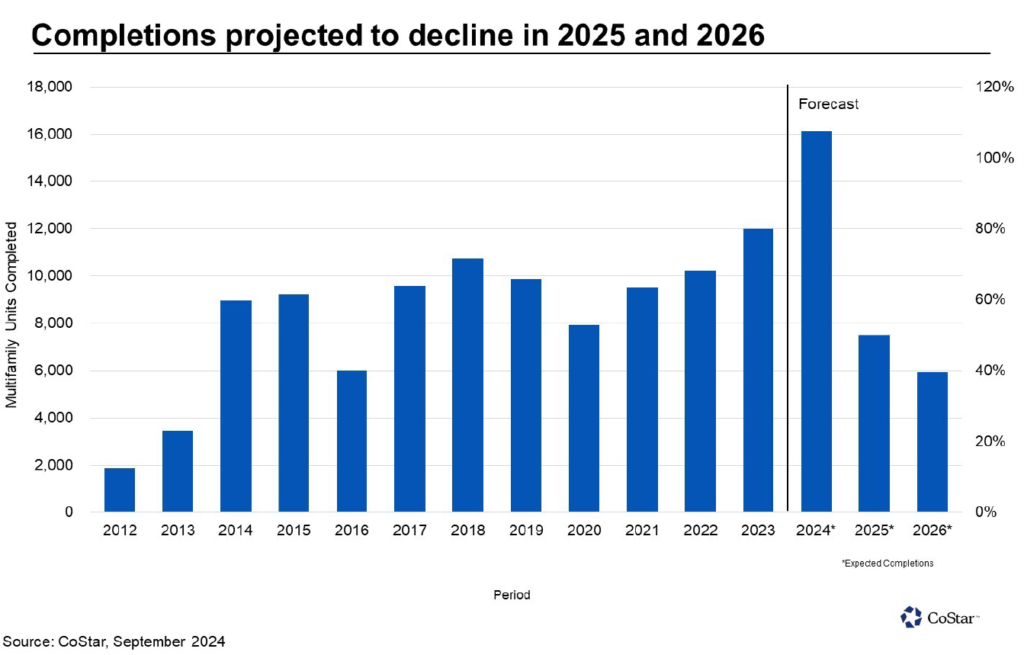

The pullback in construction is setting the stage for tighter market conditions, and ultimately stronger rent gains, in the years ahead. While a record 16,000 units are projected to be completed this year, that figure is projected to fall to 7,500 units in 2025, CoStar forecasts.

The pipeline is projected to fall even further in 2026 to just 5,900 units. That would mark the lowest level of annual completions in over a decade.