Opportunity for more apartment construction ranked third out of 50 largest U.S. cities by CBRE

By JOE RUBINO | jrubino@denverpost.com | The Denver PostPUBLISHED: February 6, 2021 at 6:00 a.m. | UPDATED: February 6, 2021 at 3:35 p.m.9

The COVID-19 pandemic has disrupted nearly every facet of life but when it comes to its long-term impacts, real estate services firm CBRE doesn’t see the virus derailing Denver’s status as a premier market for more development.

CBRE released a report this week ranking the development prospects in America’s 50 most popular metro areas and placed Denver sixth overall, trailing only Atlanta, Dallas, Phoenix, Orlando, Fla., and Seattle.

The analysis ranked Denver among the top 20 metro areas in the four big commercial development segments. The city was ranked third for opportunities for future multifamily housing, fourth for new retail, 11th for industrial development and 16th for office space.

“Years of strong population and employment growth have triggered steady demand for additional capacity within nearly all facets of local real estate,” Pete Schippits, CBRE’s Denver-based president for the Mountain-Northwest division based, said in a news release.

CBRE’s rankings were based on construction costs, the strength of the market fundamentals underpinning the existing real estate supply, performance during the last economic cycle and property forecasts.

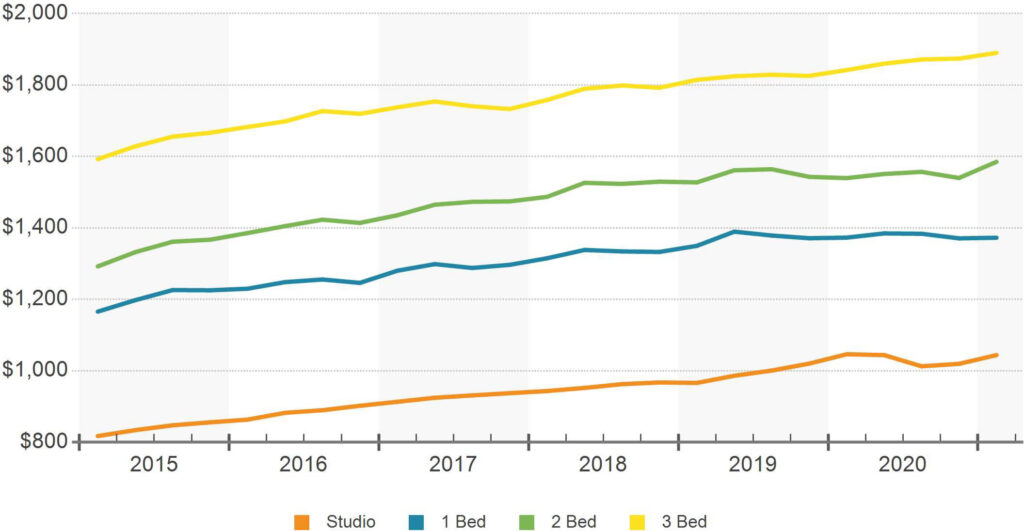

The report singled out Denver’s multifamily market — that being apartments but also condos — for its strong performance during the metro area’s decade-long boom before the pandemic. The city ranked seventh in the nation for new units filled over the last 10 years and saw more rent growth than all but three other cities. That growth was painful for many renters but it’s bait on the hook for developers and investors

Earlier this week, Charlotte, N.C.-based Crescent Communities announced it was starting construction on a 483-unit luxury apartment building at 1300 40th St. in Denver’s Cole neighborhood. The $181 million project, called Novel RiNo in reference to the River North Art District, will also include retail space and an undisclosed number of affordable units, according to a news release.

“Denver is a place we identified years ago for its long-term potential, and we are excited to find an opportunity that matches our investment criteria,” Jonathan Winson, a senior vice president with Dart Interests, the project’s equity partner, said in a statement.

The city’s office market has taken a beating during the pandemic. Office space available for sublease shot up by 86% during the pandemic, reaching 4.7 million square feet by the end of 2020, according to CBRE research.

The number of office jobs in Denver is expected to grow by 5.4% over the next three years — good for the 35th best rate out of the 50 markets analyzed — but slow growth doesn’t mean there won’t be opportunities for development. Changing needs and demands brought on by the pandemic are causing employers across the nation to reconsider their workspaces, according to CBRE research.

“We expect to see a significant uptick in tenant fit-out projects in 2021 as employers redesign and reconfigure spaces to accommodate new standards in health, wellness and safety,” Jim Dobleske, CBRE global president of project management, said in a statement.Popular in the Community.

CoStar Submarket Report – North Jefferson County:

Deliveries have been more muted in 2020 than in 2019, allowing submarket vacancies to stabilize during the pandemic. But North Jefferson County had no trouble mitigating supply-driven pressure on vacancies before the pandemic. For the third consecutive year, more than 600 units delivered in the submarket in 2019. Absorption was strong enough to keep vacancies within 100 basis points of their three-year average at the start of 2020.

Investors remained bullish on North Jefferson County’s multifamily outlook in 2019. Sales volume reached a record high, near $250 million, as the price per unit jumped in both transaction and CoStar’s Market Pricing trends.

View the full Submarket Report here.