As seen on CoStar

City’s New Initiative Could Lead to Similar Drop in Permit Applications for New Projects

Housing affordability has increasingly become an issue across the nation. The rise of remote work prompted record numbers of renters to take advantage of their newfound freedom, and many traded in sky-high rents in gateway markets for larger, more affordable units in smaller markets.

The rapid migration of people across the United States led to widespread double-digit rent gains as demand for apartments spiked to record levels.

In response, several cities have introduced affordable housing policies, Denver included.

The Denver City Council passed an inclusionary zoning initiative that went into effect on July 1. New housing developments with 10 or more units are now required to set aside between 8% and 15% of units as affordable, depending on factors including location and the level of affordability those units will provide. Affordable units are income-restricted housing for households making between 60% and 90% of the area media income.

There’s been plenty of opposition to the new policy in Denver, with concern that it could lead to a decline in new construction as developers shift their focus to markets with fewer restrictions.

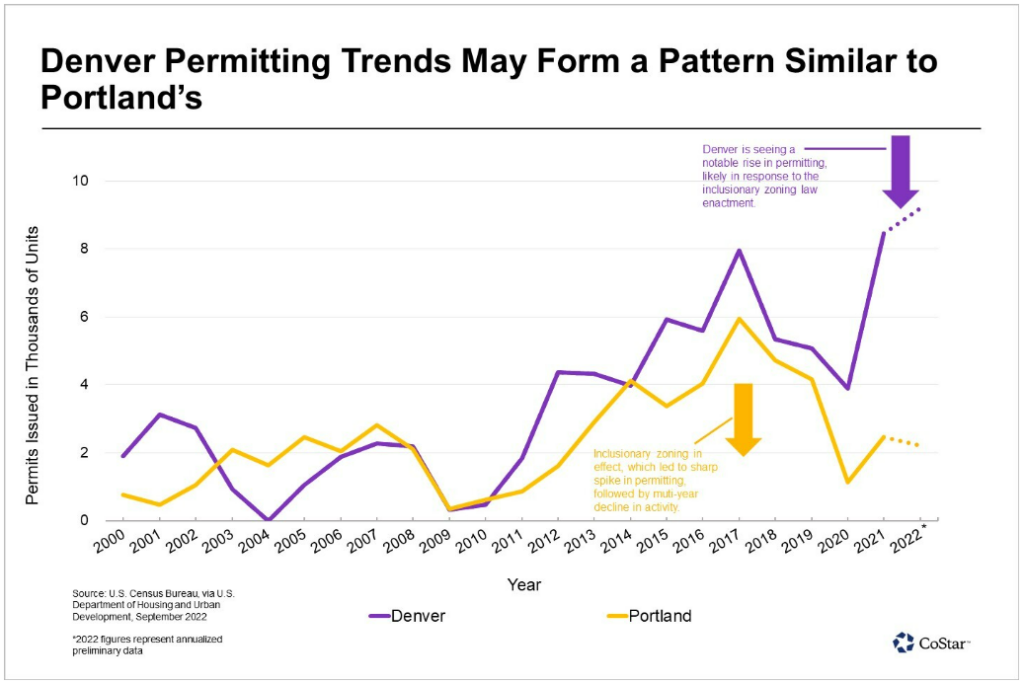

The city of Portland, Oregon, passed a similar affordable housing policy in 2017, and data released by the U.S. Census Bureau indicates Denver may be on the same path that Portland took following the announcement and subsequent implementation of its inclusionary zoning policy.

Portland’s permitting activity surged to nearly 6,000 units in 2017 as developers rushed to get projects approved before the new law went into effect. However, following this initial surge, activity fell off at a swift pace. While there is evidence that Portland’s pipeline hit a bottom in 2020 and is beginning to recover, the total permitted unit figure last year was still 50% below the 2017 peak.

In Denver, a similar run-up in permitting occurred. As word got out that a new policy was coming and demand surged, Denver saw permitting activity for new projects spike to a record of nearly 8,500 units in 2021, and another 4,600 units were permitted through mid-year 2022.

If Denver follows the same trajectory as Portland, the city could see permits drop to just under 2,000 by 2025.

In contrast, the Seattle City Council voted through a policy of its own in 2019, referred to as incentive zoning. The program is designed to encourage developers to incorporate more affordable housing by allowing for taller, denser buildings to help offset costs.

Three years after its passage, the Seattle apartment pipeline still remains near record levels. However, in Portland and Denver, there has been little added benefit for developers, raising concern that Denver developers, like Portland, may curtail projects in the near term without an added incentive.

While a decline in development may be on the horizon, the Denver apartment market is already facing a historic supply wave with 25,000 units in the pipeline. Most of the construction is concentrated in Downtown, where 9,000 units are underway, on top of the 2,500 units that opened in the past 12 months.

Instead of exiting the market entirely, development could shift to the surrounding suburbs. Denver’s affordable housing policy only applies to projects located within Denver’s city limits.

If Denver does experience a drop in developer interest, it’s likely temporary. After reaching a bottom in 2020, developers are getting active in Portland again. In the last two years, permitting activity has been on the upswing again, increasing by 20% during this period.

Though there has been plenty of opposition, there has also been praise for the initiatives, with some developers viewing these mandates as an inevitable next step given the current environment, and recognize it is in line with what many other U.S. cities have already implemented. Advocates are focusing on the fact that a measurable number of affordable units will be available to renters of a certain income level, something that wouldn’t exist without intervention.