As seen in Colorado Real Estate Journal

The accompanying stats and market statistics are for the private client and middle market space defined by 10- to 200-unit buildings in the Colorado Front Range. The data has been compiled from CoStar, Apartment Insights, and the Federal Reserve Bank of St. Louis. In this article, I will discuss the past (2010-2021), the present (2022-2024) and the future (2025-2029) while also addressing market conditions that led to the sales and transaction volumes during each period. The future is never crystal clear, but with the help of historical data and statistics, I believe brighter days are ahead for the Colorado market.

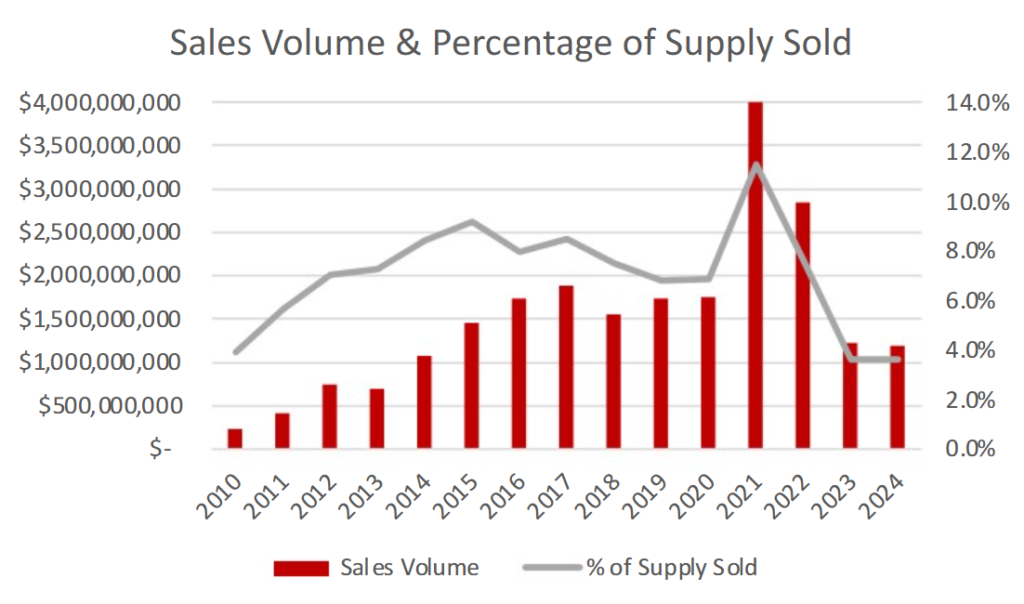

From 2010 to 2021 the number of transactions and overall sales volume increased 10 out of 12 years. Incredibly, the growth of sales volume in this period averaged 36% per year. The market went from $225 million in sales in 2010 to $4 billion in sales at the 2021 peak, equating to a 1,677% increase! In 2010, 3.9% of the total building inventory sold, compared to 11.5% in 2021. It is important to note that 2021 was an outlier year thanks to historically low rates, high rent growth, and buyers eagerly looking to transact after COVID-19. Some of the macro fundamentals influencing investments in 2021 included a 10-year Treasury at 1.39%, annual rent growth of 7.9%, and 11.5% of the total supply transacted. Over the last 20 years, the 10-year Treasury has averaged 2.85%, rent growth has averaged 2.76%, and 6.7% of the total supply transacted. 2010-2021 was a great run capped off by the highest sales volume Colorado has ever seen.

Since 2022 we have seen declining sales and transaction volume. 2022 and 2023 ended at $2.84 billion and $1.22 billion in total volume. In fact, in 2023 sales volume decreased by 57%, a rate of decline not seen since 2009. As I write this article, the year-to-date sales volume is currently at $600 million, which would put 2024 on pace for 2023 volume. Rate increases and supply have been the largest factors affecting the Colorado market. As a solution to combat inflation, the Fed made the first rate hike in March 2022, increasing the federal funds rate to a range of 0.25%-0.5%. The Fed raised rates 11 times between March 2022 and July 2023; the final increase in 2023 brought the rate to 5.25%-5.5%. While this pattern from the Fed has impacted buyer underwriting, the good news for our market is that capital from coastal and other domestic markets still wants to invest here. This deep pool of investors has lessened the rise of sales cap rates in Colorado to a slower pace than in other U.S. markets. Many Colorado private client and middle market buildings are still being priced at negative leverage, which means the cap rate is lower than the cost of borrowing.

According to Apartment Insights, the current Colorado Front Range development pipeline has 53,712 units under construction and 80,993 proposed. The current development pipeline hurts rent growth due to competition among developers to stabilize properties. Rates and the current development pipeline are negatively affecting the multifamily market, but we are beginning to see positive news and trends for the future.

From 2025 to 2029, the Colorado multifamily market will improve as we see rate cuts and continued absorption of the current development pipeline. Many traders and analysts are predicting multiple rate cuts over the next 18 months. Citi Bank predicts the Fed could cut rates by 200 basis points over the next eight meetings. As financing normalizes, we will see less negative leverage and transaction volume will increase. As discussed before, Colorado has a robust development pipeline, and we have already started to see signs of increased absorption. Apartment Insights reports that 3,569 units in the Denver metropolitan area were absorbed in the last quarter, an 87% increase from the first quarter of 2024. For those who want to argue seasonal leasing, compared to the second quarter of 2023 it was an increase of 100%!

The new supply is also being slowed down. It is important to note that the difficulty of raising development equity in the current environment has a significant impact on the actual pipeline that is delivered.

It will become easier to finance acquisitions in 2025, but it may take until 2026 to see equity readily available for new developments. The construction of many buildings will be delayed, and others will be completely put on hold. With the average apartment building taking 18-24 months to construct, there will be a nice buffer for the current supply from 2027-2029. We will start to see the market improve in 2025. In 2026 we should be back to a market in line with historical transaction averages. With the help of historical data, my crystal ball shows that in 2026 we will have 275-plus transactions and nearly $3 billion in sales volume in the 10- to 200-unit building size.

Yes, 2010 to 2021 was a great time for multifamily real estate in Colorado, when sales volume increased by an average of 36% each year. Conversely, the last three years have been a difficult time for transactions due to increased rates and the current development pipeline. From 2025 to 2029, rates will lower, the development pipeline will absorb, and sales volume and pricing will increase. Brighter days are coming, don’t give up now!